Business Insurance in and around Fremont

Calling all small business owners of Fremont!

Helping insure businesses can be the neighborly thing to do

Business Insurance At A Great Value!

As a business owner, you have to manage all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Tim Lambert. Tim Lambert gets where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

Calling all small business owners of Fremont!

Helping insure businesses can be the neighborly thing to do

Keep Your Business Secure

If you're looking for a business policy that can help cover extra expense, business property, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

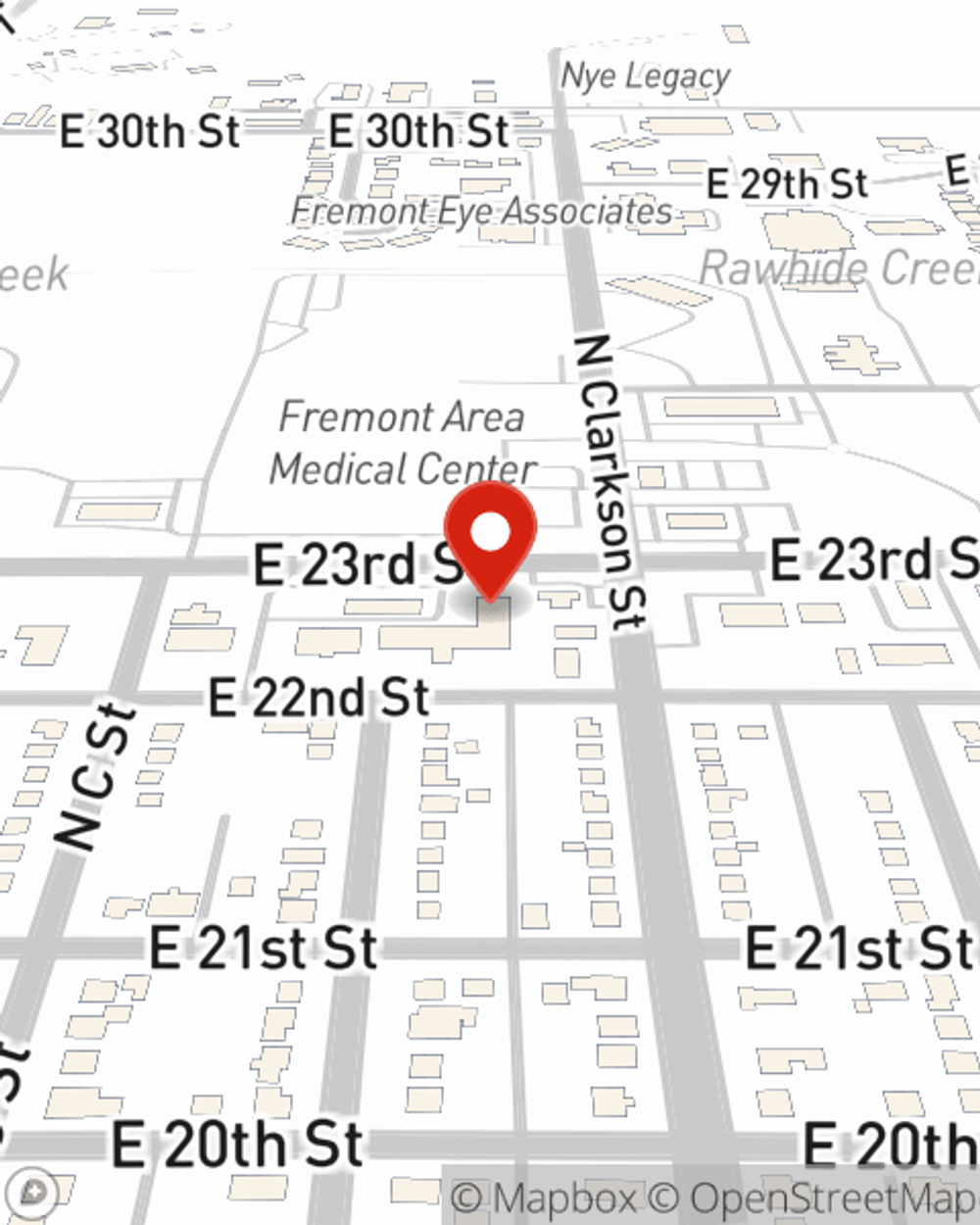

Get in touch with State Farm agent Tim Lambert today to check out how one of the leading providers of small business insurance can ease your worries about the future here in Fremont, NE.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Tim Lambert

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.